Short Put Risk Profile

|

Stock Price

|

$77.00

|

|

Put Premium

|

5.58

|

|

Exercise Price

|

80.00

|

|

Time to Expiration

|

4 months

|

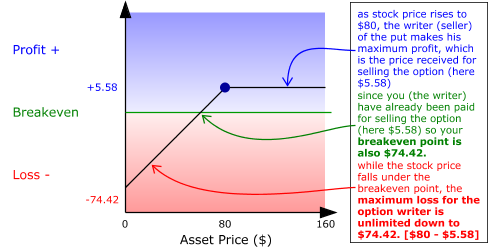

Remember that we already discussed the implications of selling an option - here's another reminder for puts:

Selling (naked) imposes the obligation

-

Selling a put obliges you to buy the underlying asset to the option buyer. Remember, when you sell a put, you have sold the right to sell to the person who

bought that put.

-

Selling options naked (ie when you have not bought a position in the underlying instrument or an option to hedge against it) will give you an unlimited risk profile. The continuous

downward diagonal line is generally a bad sign because it means uncapped risk.

-

Combined with the fact that you are obliged to do something, this is not an ideal strategy for the inexperienced.