Put / Call Parity Explained

Call premiums, put premiums and the associated asset prices are all related to each other.

This must be the case or else professional traders would be able to arbitrage (make risk free trades).

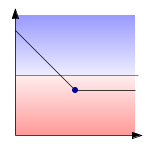

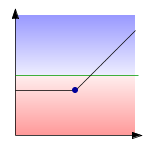

Put-call parity is a fundamental relationship that must exist between the premiums of a put option

and call option if both have the same underlying asset, strike price and expiration date.

The put-call parity model is based on expiration date investment values associated

with 4 different securities:

-

A call option;

-

A put option with identical terms;

-

The underlying asset for the above call and put;

-

A risk-free security with the same maturity date as the options' expiration date and

with an expiration payoff equal to the options' strike price.

Put-call parity is used for 2 purposes:

-

To value a call option relative to a put with identical terms.

-

To show how the expiration date payoffs on any one of these 4

securities can be replicated by taking appropriate positions in the

other 3 securities (ie creating synthetic positions).